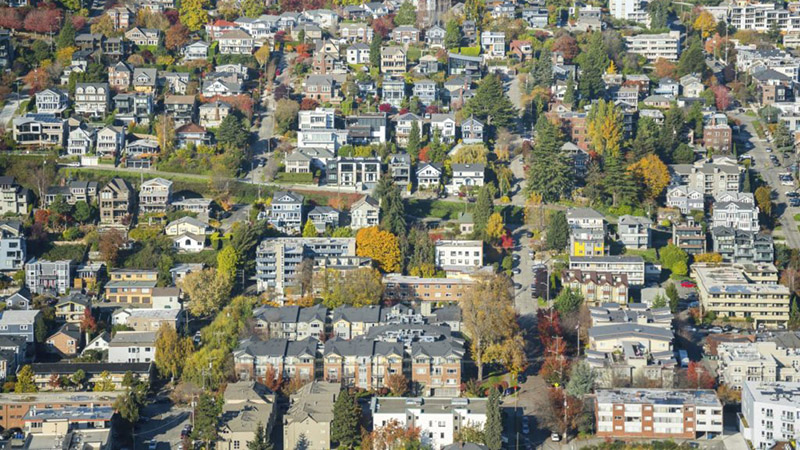

Washington State is facing one of the worst housing crises in the nation. According to data from Lieutenant Governor Denny Heck, Washington State has the fewest number of housing units per household of any state in the country. In the 2023 legislative session, the Washington State Legislature has identified housing as one of the key strategies needed to achieve economic stability and growth. Several bills have already been introduced to work towards these goals.

We at the Washington Trust for Historic Preservation are committed to promoting sustainable and economically viable communities through historic preservation. As part of this mission, we recognize the importance of addressing the affordable housing crisis in Washington State and the potential role that historic preservation can play in providing affordable housing and increasing housing density.

A small percentage of buildings and parcels throughout Washington cities are included in local historic districts: estimates indicate that locally listed historic buildings and local historic districts comprise less than 1% of buildings/parcels in Seattle, Tacoma and Spokane – cities with the most local landmarks. Yet, historic resources play important roles: research has shown that historic buildings and neighborhoods contribute significantly to the environmental, economic, social, and emotional health of communities and their residents. At the same time, we acknowledge barriers to affordable housing, such as lengthy development approval processes and outdated zoning codes, that hinder the ability to leverage old and historic buildings as assets for economic development and resilience in cities.

We are working with the legislature to position historic resources as an important part of the overall housing discussion. We have commented on the following bills, and encourage you to do the same!

House Bill 1110/Senate Bill 5910 –

Missing Middle

Seeks to remove barriers to building important “middle housing” (duplexes, triplexes, quadplexes, apartments, etc.) by eliminating single-family zoning in cities.

House Bill 1026 –

Design Review

Seeks to eliminate design review boards for housing development permit applications and limit review to administrative reviews.

House Bill 1042 –

Building Reuse

Seeks to eliminate restrictions on housing units constructed within existing buildings, allowing underutilized or vacant buildings to be converted into housing.

Historic resources and historic districts have accommodated growth in cities over time. Incentives at both the federal and state level support rehabilitation of historic buildings, which often includes improvements to or creation of housing units. Moreover, there are relatively few local historic districts in Washington that feature primarily single-family building stock. In those that do, a significant portion of these structures has been converted to multi-family use. Such conversions, along with the creation of ADUs and DADUs, tend to create housing units that are more affordable than newly constructed units, and do so without burdening our landfills with construction debris from demolition.

Make Your Voice Heard

If you want to make sure that state legislators advance housing goals while preserving Washington’s historic places, you can help! As a constituent, you can either request a virtual meeting with your legislator or email them your concerns.

If you are unsure of who your legislators are, enter your address in the state District Finder. You can also find email contact information for all legislators and their aides here.

As you do your outreach, keep the following points in mind:

- Across the state, locally designated historic buildings and districts comprise a very small percentage of overall buildings and parcels (in Spokane, Tacoma and Seattle, estimates indicate that less than 1% of buildings/parcels are locally designated).

- Federal rehabilitation tax incentives have supported the creation/rehabilitation of 1158 housing units over the last five years—nearly 60% of which were classified as low to moderate income units.

- The state’s Special Tax Valuation Program has supported the creation/rehabilitation of more than 900 housing units in the last five years.

- Preserving, retrofitting, and upgrading existing housing units is often less expensive than building new. Lower conversion costs lead to lower rents than the rent needed to support new construction.

- Re-using existing buildings retains the embodied energy utilized as the buildings were originally constructed and prevents unnecessary demolition debris from being deposited in our landfills.

To really make these proposals heard, we need your help. Contact your representatives or use the form below to encourage them to support bills that address the state’s urgent housing needs through existing and new historic preservation frameworks.

Simply enter your name and address, and we will match you with your representatives and provide a letter for you to send directly with a few clicks!